Home » Australian Sustainability Reporting Standards (ASRS) Explained – What you need to know

Australian Sustainability Reporting Standards (ASRS) What you need to know

We take for granted that in most areas of business reporting, especially relating to finances, there are standard frameworks and terminology followed around the world.

When it comes to ESG or sustainability reporting, however, consistent standards are less widely established and adopted. But this is fast changing; it’s important for business leaders to stay up to date on how it will impact their requirements – either under law (depending on their country or jurisdiction), or as a result of rising expectations from Board members, investors, customers and other stakeholders.

Australia is currently in the process of establishing its own standards – the Australian Sustainability Reporting Standards (ASRS), which will be complemented by new legislation that will enforce mandatory climate-related disclosures for some organisations.

In this article we’ll cover:

- What are the ASRS?

- How do the ASRS relate to international sustainability reporting standards?

- Are the ASRS mandatory? Who do they apply to?

- What your company needs to report on as part of ASRS

- How your company can prepare to align its reporting with the new standards

What are the Australian Sustainability Reporting Standards (ASRS)?

In 2024, the ASSB developed the ASRS, including the introduction of a mandatory reporting standard. The ASRS are a framework designed to guide Australian companies in disclosing their environmental, social, and governance (ESG) practices. These standards ensure that businesses provide transparent and consistent information about their impact on the environment, their social responsibilities, and the ethical management of their operations.

The ASRS have been developed by the The Australian Accounting Standards Board (ASSB), an independent government agency responsible for developing and maintaining accounting standards in Australia. These standards set the rules for how financial reports should be prepared and presented by organisations to ensure consistency, transparency, and comparability. The AASB’s work is essential for providing stakeholders—including investors, regulators, and the public—with reliable financial information that supports informed decision-making. The AASB also contributes to the development of international accounting standards.

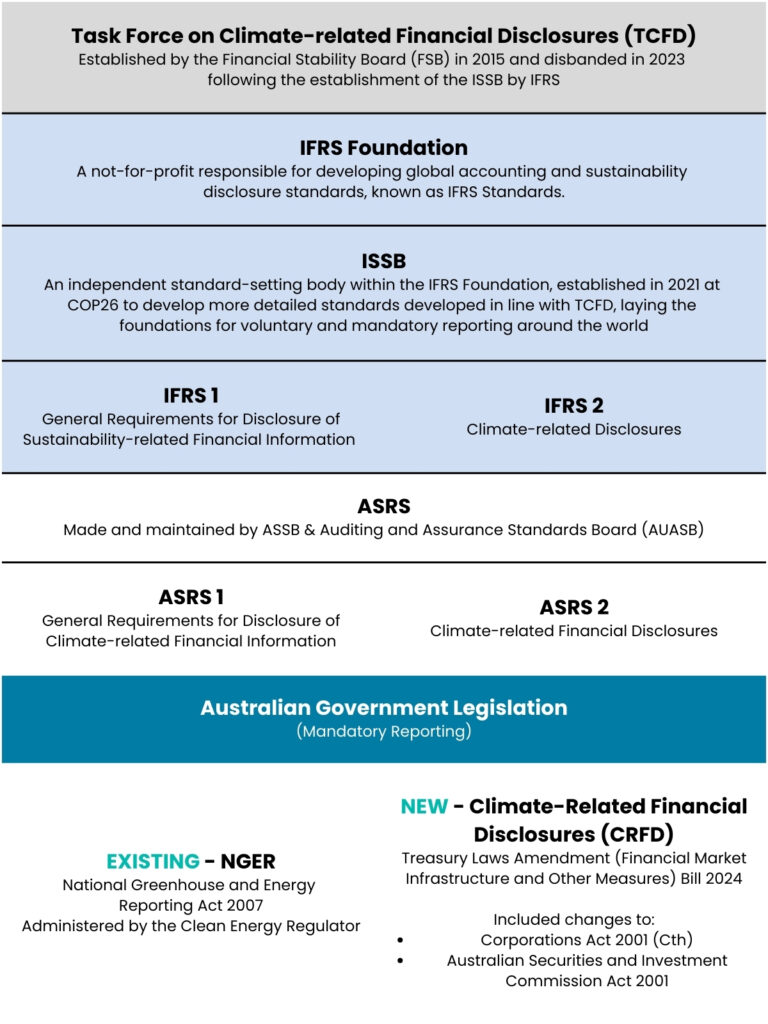

How do the Australian standards relate to international sustainability reporting standards?

The Australian Sustainability Reporting Standards are designed to closely reflect the International Sustainability Standards Board (ISSB) International Financial Reporting Standards (IFRS), ensuring that Australian companies are aligned with global best practices in sustainability reporting.

The ISSB was established to create a global baseline for sustainability reporting, providing consistent, comparable, and reliable information for investors and other stakeholders. The ISSB standards are part of a broader effort to standardise sustainability reporting across the globe, addressing the growing demand for transparency in how companies manage environmental, social, and governance (ESG) issues.

Overview of sustainability reporting frameworks

Are the ASRS mandatory for every business?

The ASRS includes two separate standards – ASRS 1 and ASRS 2 – the former being a standard for voluntary reporting to cover all sustainability-related financial disclosures, and the latter for mandatory reporting of climate-related impacts.

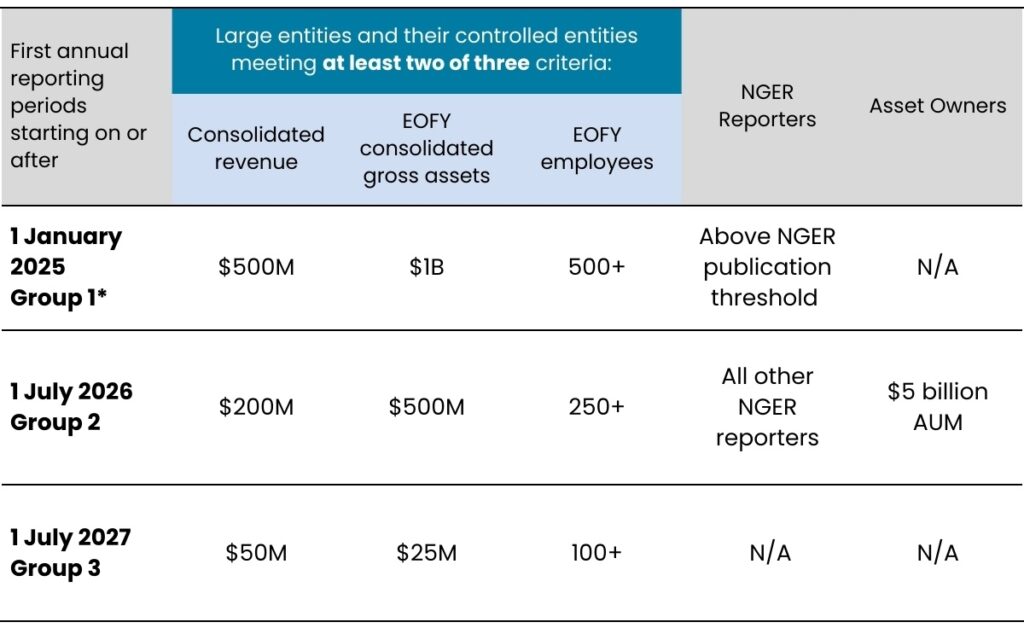

The ASRS 2 is now supported by new legislation, enforcing climate-related disclosures for some companies, following amendments to the Corporations Act and Australian Securities and Investment Commission Act. The relevant Bill (Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Bill 2024) was passed by Parliament on September 9th 2024. As a result, companies are now required to report, if or when they fall into the relevant ‘Groups’, depending on various eligibility criteria, as detailed in the table below.

Reporting Implementation Timeline

Is your business ready for 1 January 2025?

While the new legislation officially passed on the 9th September 2024, the final details of these new climate reporting standards may not be finalised until a few months prior to the first deadline (for Group 1) of 1 January 2025. This leaves only a short period of time for companies to prepare.

Furthermore, many companies that don’t fit the criteria to fall into Group 1 will also need to be preparing some data for climate reporting during this time, if they have larger companies as customers who do fall into Group 1. This is due to the requirements for companies to report on their Scope 3 emissions – those emissions created in their supply chain.

In short – if your company has not yet started preparing to report, doing so should be an urgent priority in order to avoid any ramifications as a result of late or inadequate reporting in line with the timelines outlined above.

What your company needs to report on

Mandatory climate-related reporting under the new legislation requires a company to submit a ‘sustainability report’ as part of their annual financial reports, which will involve reporting on climate-related risks and opportunities that may impact the business.

This will need to include:

- a climate statement for the year;

- any statement prescribed by the regulations for the year;

- notes on either (i) or (ii); and

- the directors’ declaration as to the compliance of the statements with the relevant sustainability standards.

The focus areas for reporting include:

| Governance | The organisation’s governance around climate-related risks and opportunities. Board oversight & management involvement. |

| Strategy | The actual and potential impact of climate-related risks & opportunities on your businesses, strategy, and financial planning. Short, medium, and long-term. |

| Risk Management | The processes used to identify, assess, and manage climate-related risks. This includes physical, transitional & legal risks. |

| Metrics & Targets | The measurement used to assess and manage relevant climate related risks and opportunities. |

Alignment with International Standards

The ASRS 2 align closely with the international IFRS S2 standards, ensuring climate-related disclosures are clear, consistent, and comparable.

More specifically, both ASRS 2 and IFRS S2:

- Emphasise the need for companies to disclose important climate-related risks and opportunities, including physical risks like extreme weather and transition risks like regulatory changes.

- Require companies to report on the financial impacts of climate risks, making sure that the disclosed information is relevant to stakeholders.

- Provide industry-specific guidance and encourage using scenario analysis to plan for different climate futures.

- Require reporting on greenhouse gas emissions, including Scope 1, Scope 2, and relevant Scope 3 emissions.

By aligning ASRS 2 with IFRS S2, Australia is ensuring its companies can meet both local requirements and global investor expectations, making climate reporting straightforward and reliable.

How to prepare

Whether or not you are required to report under mandatory schemes, it’s time to understand your impact.

We recommend any company undertake the following measures:

- Learn about the reporting you need to do, and when it needs to be done by.

- Stay current with evolving regulations.

- Figure out the resources you already have available, and what assistance you may need, including from external experts.

- Examine your organisation’s sustainability desire, commitments and current systems

- Begin creating a roadmap and gap analysis to determine what needs to be done by when.

- Decide how you want to start integrating climate resilience into your business model.

- Understand your current data management and policy gaps to give your organisation time to upskill and resource appropriately.

- Consider the tools you’ll need, including data management software or carbon accounting platforms like Climate Zero.